Need More Help? Book Your FREE Strategy Session With Our Team Today!

We’ll help you map out a plan to fix the problems in your trading and get you to the next level. Answer a few questions on our application and then choose a time that works for you.

Welcome back to another deep dive into the strategies we use in our trading portfolio. Today, we’re focusing on one of the most prominent assets in financial markets: gold.

A long-standing symbol of safe haven and stability, gold is also one of the most liquid and responsive asset classes in the trading landscape. In this article, we’ll break down two algorithmic trading strategies applied to Gold Futures, analyzing how they’ve performed in the current market environment, which has recently been marked by strong bullish momentum.

With the availability of the Micro Gold Future (MGC), gold trading has become more accessible to a wider range of retail traders, making it a popular choice in many systematic trading portfolios.

Let’s get into the details.

1. Gold Trend Following Strategy: A Classic Systematic Approach

The first strategy we’ll explore is based on a trend following approach—one of the oldest and most reliable methodologies in trading.

How the Trend Following Strategy Works

What exactly is trend following? In short, it means riding the direction of the market: buying when prices show strength (an uptrend) and selling when they show weakness (a downtrend). The goal is not to predict turning points, but to capitalize on trends once they become evident.

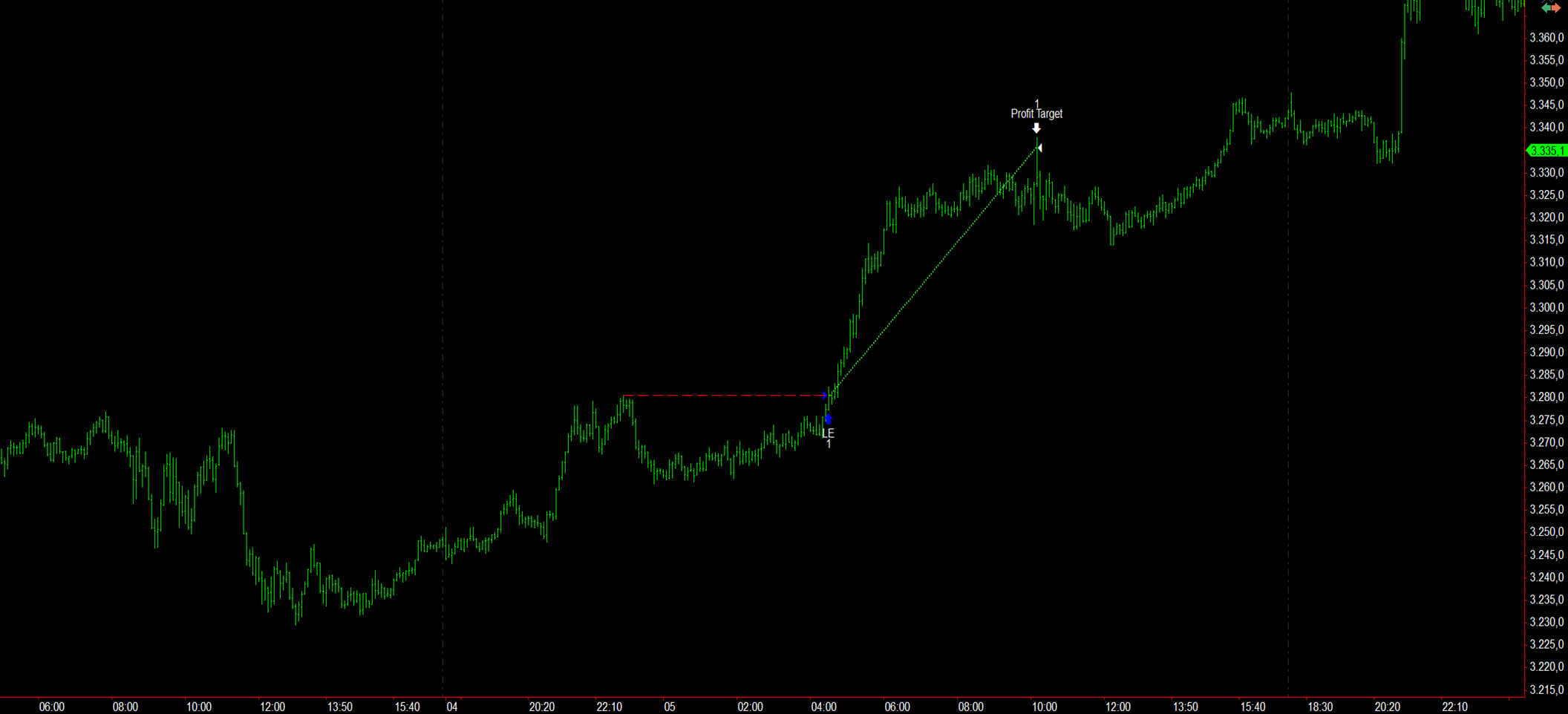

In this specific case, the system opens long positions when the session’s high is broken, or short positions when the session’s low is breached, as shown in Figure 1.

Of course, to operate this way, the system must wait a certain amount of time after the session opens so that the day’s high and low can begin to form.

Figure 1. Example of a trend following trade on Gold Futures

Trend Following Strategy Performance

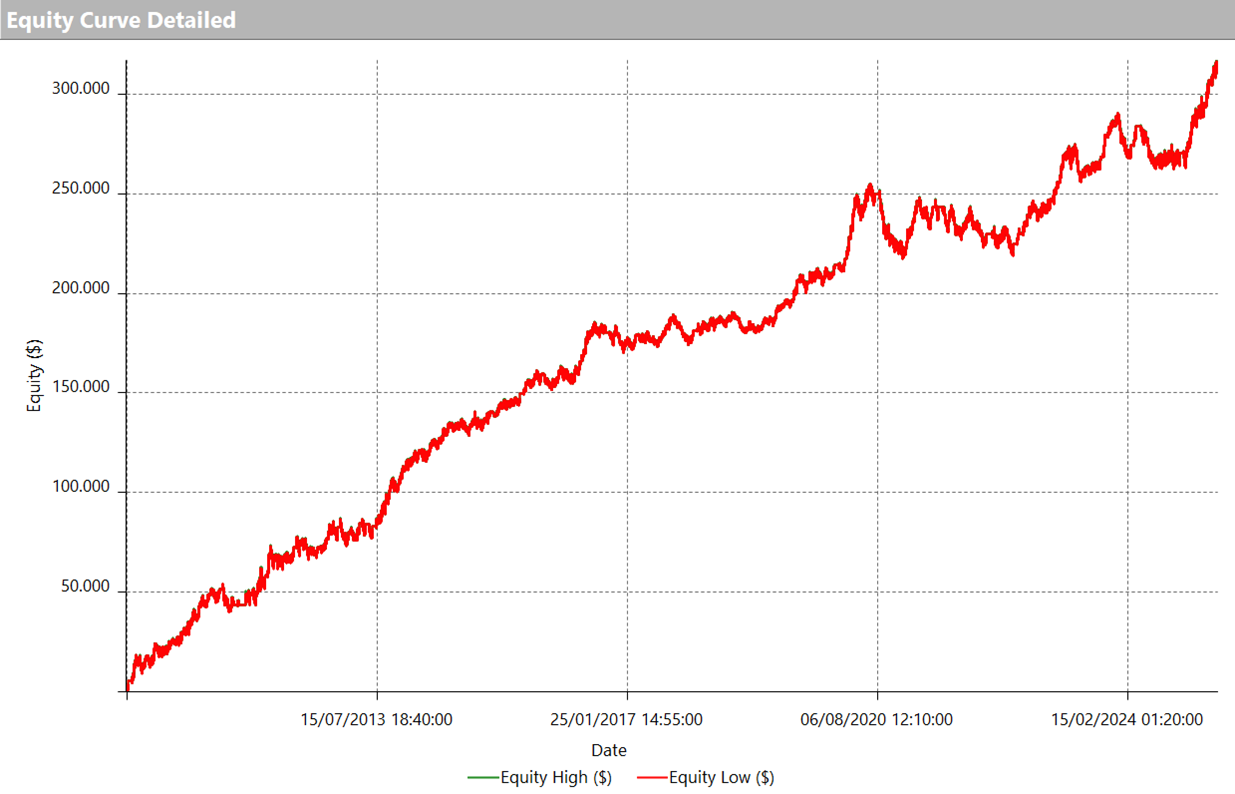

Looking at the performance, one immediately notices the strong consistency in the equity line (see Figure 2), especially during recent months. The pronounced bullish trend in gold has allowed this strategy to perform at its full potential, pushing equity to new all-time highs.

Digging into the Total Trade Analysis in Figure 3, the system shows an average trade of $303.73, a very solid result that more than covers trading costs like slippage and commissions—making the strategy viable in real-world trading. Even better, long trades alone average $449.55, highlighting how well the system captures upward momentum, especially in recent months.

Figure 2. Equity curve of the trend following strategy on Gold Futures

Figure 3. Total Trade Analysis of the trend following strategy

2. Intraday Bias Strategy with Directional Confirmation

The second strategy combines two widely used systematic trading approaches: the intraday bias, based on statistically recurring price movements in specific time windows, and a trend-following component that adds a layer of directional confirmation before trade entry.

The Logic Behind the Intraday Bias Strategy

This system focuses on time frames during the day when gold has historically shown consistent upward or downward moves. However, instead of entering trades automatically at the start of those time windows—as a classic bias strategy would—it waits for the price to break above or below recent highs or lows, integrating a confirmation filter from trend following.

This hybrid logic helps filter out false signals and improve trade quality.

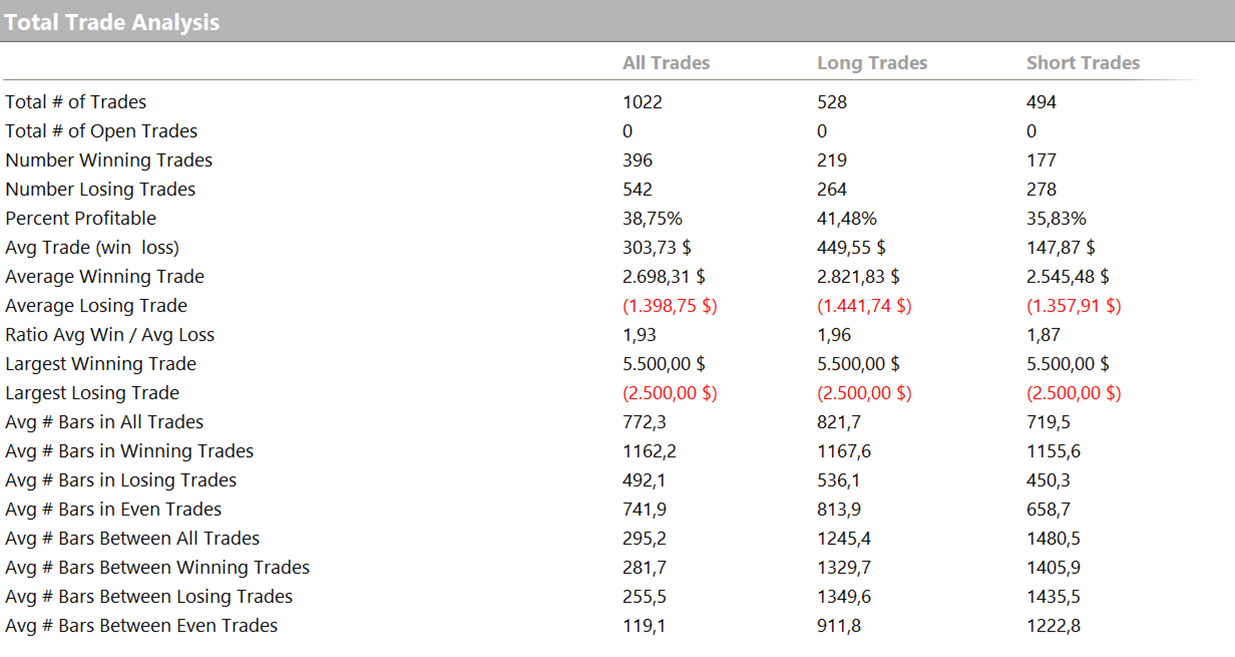

Figure 4 shows three example trades executed by the system. In each case, the system detected a statistically favorable time window, then waited for the price to break out of the previous bars’ range before entering a long or short position. Exits occur via stop loss, profit target, or a predefined time-based closure.

Figure 4. Sample trades executed by the intraday bias strategy on Gold Futures

Intraday Bias Strategy Performance

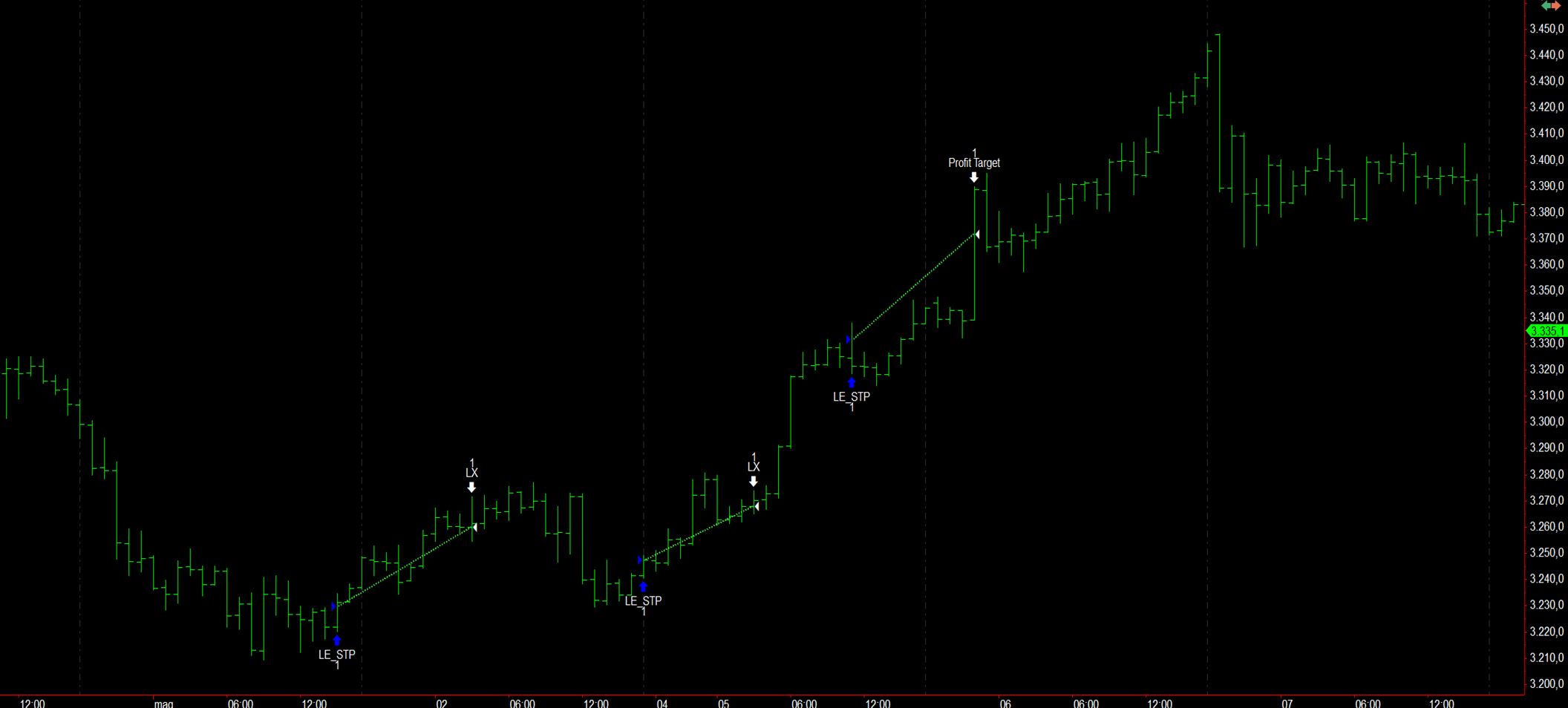

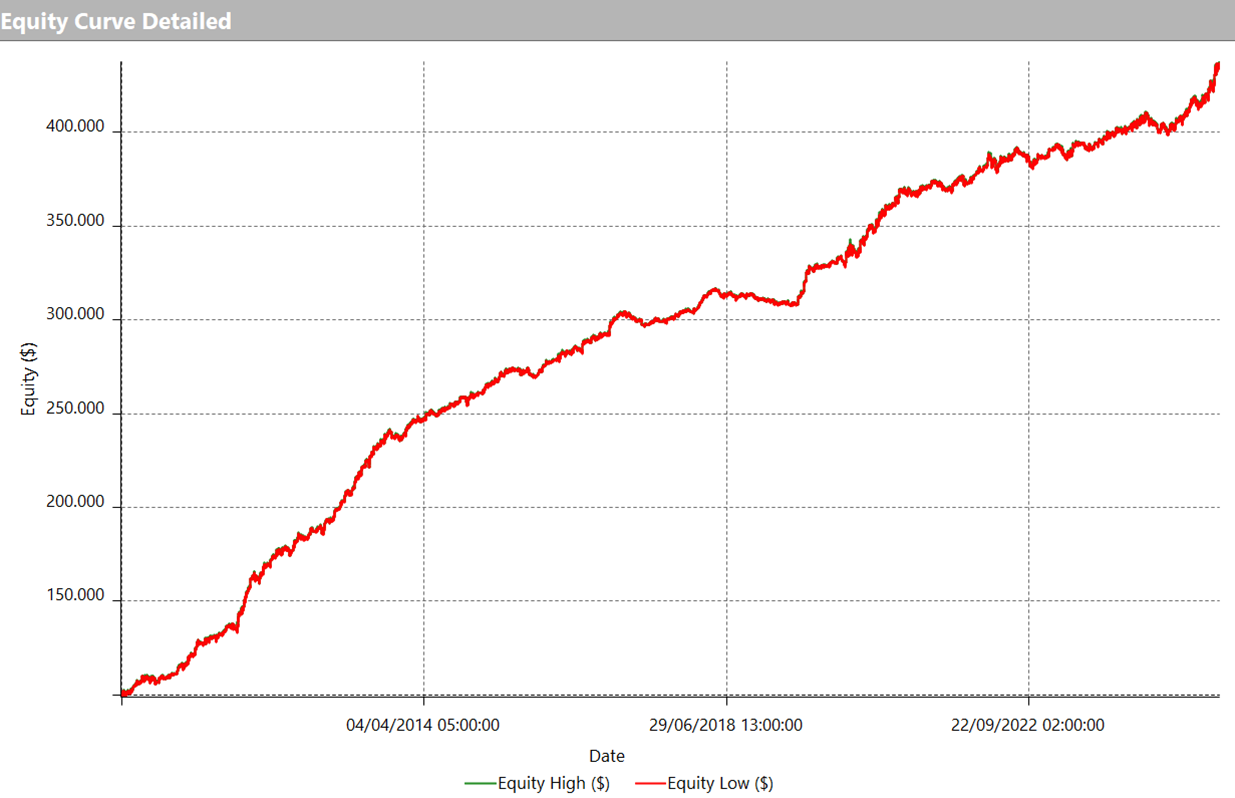

The equity curve shown in Figure 5 demonstrates steady, reliable growth. The strategy has delivered consistent profits over a span of more than 10 years without long stagnation periods. Recent market activity has confirmed the strategy’s validity, with a clear uptick in profit curve momentum, signaling excellent performance in the current gold environment.

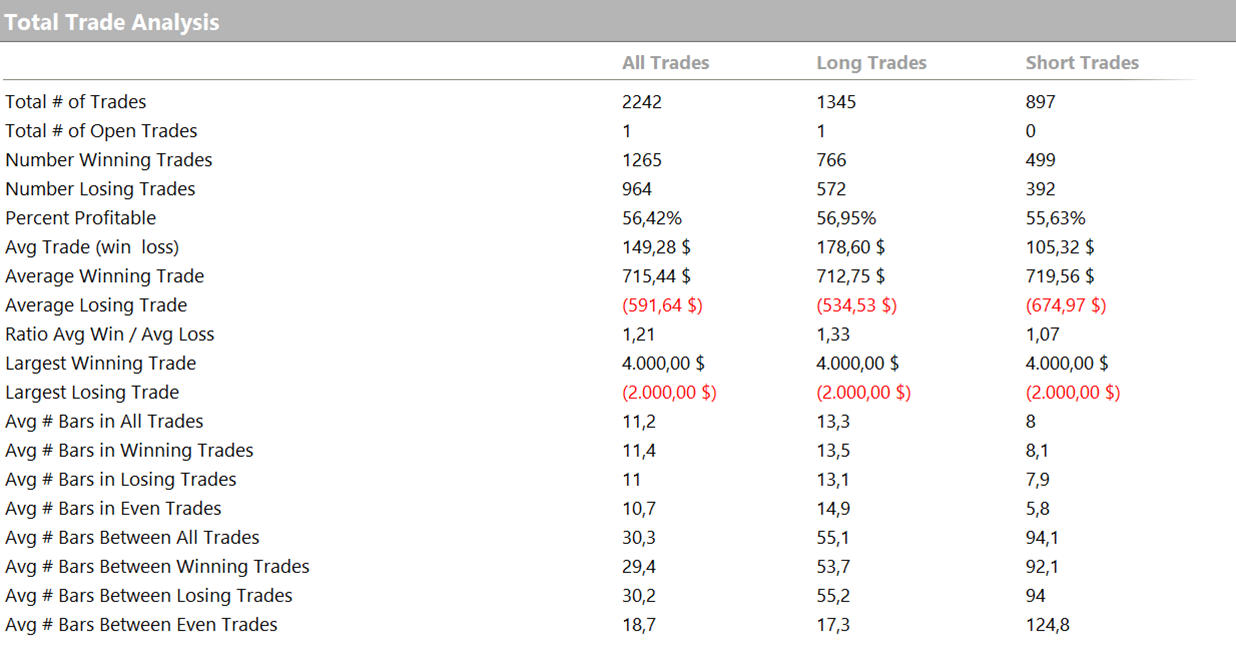

According to the Total Trade Analysis in Figure 6, the strategy posts an average trade of $149.28—a reasonable number for an intraday approach and sufficient to cover trading costs.

Figure 5. Equity curve of the intraday bias strategy on Gold Futures

Figure 6. Total Trade Analysis of the intraday bias strategy on Gold Futures

Conclusion: Why Gold Is a Strategic Asset for Systematic Traders

As we’ve seen, gold has provided excellent trading opportunities in recent months, thanks to a mix of strong directional movement and volatility—conditions that have favored both trend-following and intraday bias-based systems.

That said, it’s crucial to remember that no market condition lasts forever. We can’t predict whether gold will continue to behave this way in the coming months or shift back to more erratic patterns. That’s why our best advice remains unchanged: diversify. Not just across different instruments, but also across strategies and time horizons.

A well-balanced portfolio, built on solid and thoroughly tested strategies, is the best defense against market unpredictability. Gold, with its liquidity and the availability of micro contracts, remains a valuable asset to include—but it shouldn’t be the only one.

Interested in learning more about systematic trading on gold and other markets?

Discover the Unger Method—the very same system Andrea Unger used to win the World Cup Trading Championships® four times with real money.

👉 Watch our free Masterclass now!

Until next time!

Transcription

Need More Help? Book Your FREE Strategy Session With Our Team Today!

We’ll help you map out a plan to fix the problems in your trading and get you to the next level. Answer a few questions on our application and then choose a time that works for you.