What is Breakeven Stop and how can you use it to improve your trading performance? How do you code the Breakeven Stop to use it with different brokers? In this article, you will learn everything you need to know to successfully use this tool in your trading.

What Is the Breakeven Stop?

The Breakeven Stop is a stop order. As you may already know, a stop order is a command that tells the broker to execute a certain trade when the market price reaches a specified level. (If you want to learn more about orders, read this article: Learn the Main Trading Orders).

This stop order is useful when a previously opened position is in profit. To protect the operation from possible falls, the Breakeven Stop closes that position if the price goes down until it touches the entry level.

As the name suggests, the Breakeven Stop will exit a trade when it reaches the breakeven point.

Advantages and Disadvantages of the Breakeven Stop

The advantages of this tool are obvious. Thanks to the Breakeven Stop, when a trade becomes profitable the trader has the chance to completely protect himself from losses. In the best-case scenario, the trade will continue to be profitable, while in the worst case, the price will drop to the entry point and the Breakeven Stop order will come into play, closing the position at breakeven.

Whatever happens, by using this type of Stop, the trader ensures that the trade closes in profit or, at worst, in break even.

Of course, there are also some disadvantages. Traders can miss out on big profits if the price falls below the breakeven point and then skyrockets. In this case, the Breakeven Stop will still be triggered, depriving us of the profits.

Due to this disadvantage, many traders have doubts about the usefulness of the Breakeven Stop.

Our advice is to identify your portfolio’s level of risk tolerance. The idea behind the Breakeven Stop is to protect yourself from risk when a certain profit target has been reached.

That said, let’s see in practice how you can use the Breakeven Stop to improve your trading performance.

How to Use the Breakeven Stop in Systematic Trading

The Breakeven Stop is used in both discretionary and systematic trading.

In discretionary trading, Breakeven orders are generally pretty short. This approach, however, can be somewhat risky in systematic trading.

The goal of a systematic trader is to pre-program trading instructions to be executed automatically with no further input required. Since the computer will have to act autonomously, it would be risky to set very short stop orders because the platforms would hardly be able to test them effectively in situations where the width of the bars used for the backtest exceeds that of the value of our breakeven point.

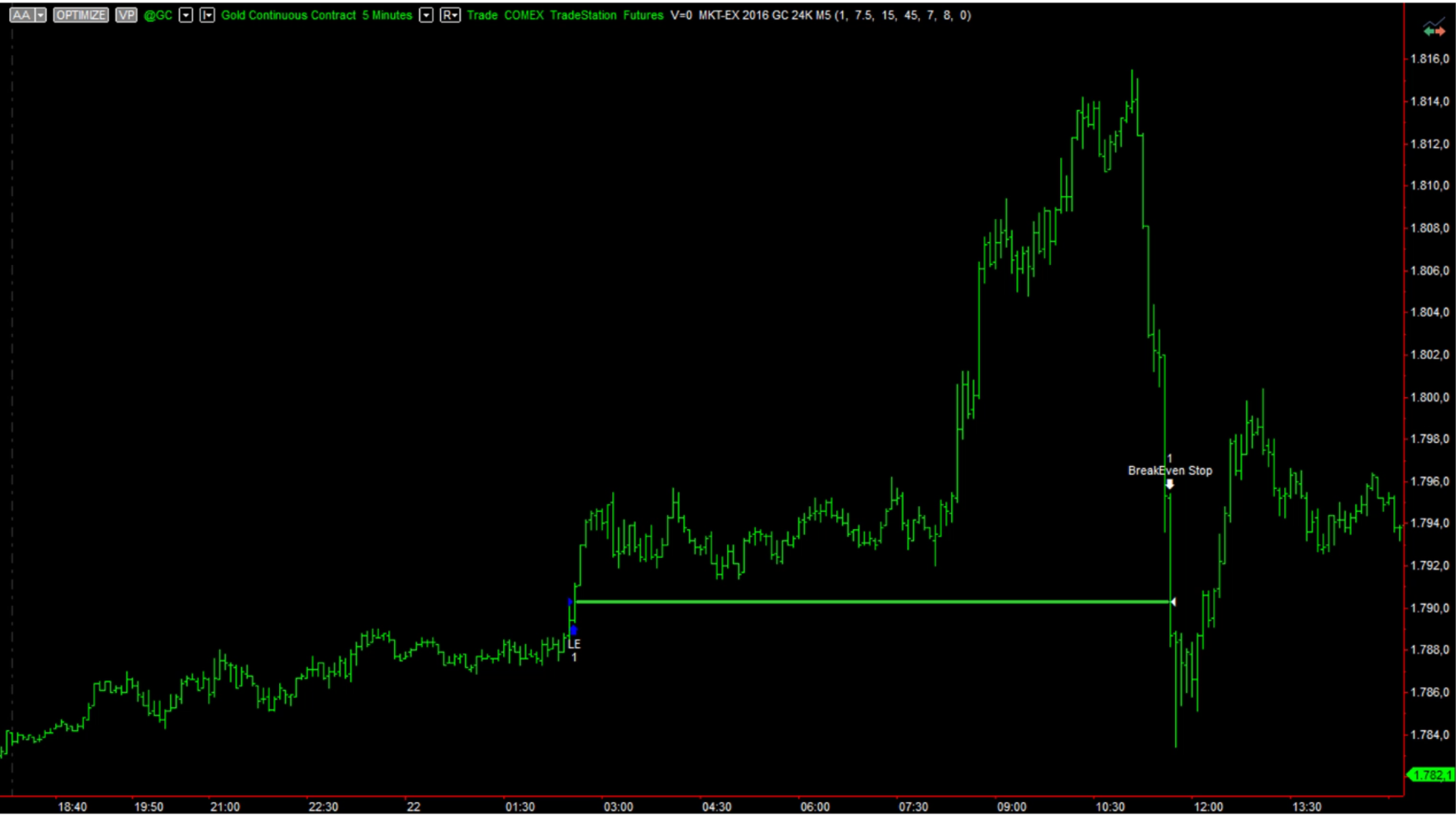

That said, let’s see an example of how to apply the Breakeven Stop on the Gold future.

As you can see, the Breakeven Stop was applied after the entry, with an active trade. In this case, the market first rose and then fell heavily, So the Breakeven Stop came into play and closed the position.

How to Code the Breakeven Stop in MultiCharts and TradeStation

The coding of this tool within MultiCharts and TradeStation is quite simple. In fact, it is enough to use two specific keywords. In this video, you will find a detailed explanation from one of our coaches. If you want to skip the introduction and see how coding is done, skip to minute 5:08.

Furthermore, as you can see in the video starting from 7:35, we offer you the encoding of an “alternative” version of the Breakeven Stop.

In this version, the Stop is not exactly at breakeven but is set slightly above or below the entry price as if it were a Stop Loss or a Take Profit. This approach can help protect against the impact of commissions, spread, and slippage costs.

This tool is not pre-configured in MultiCharts and TradeStation. However, as you can see in the video, coding it manually is quite easy.

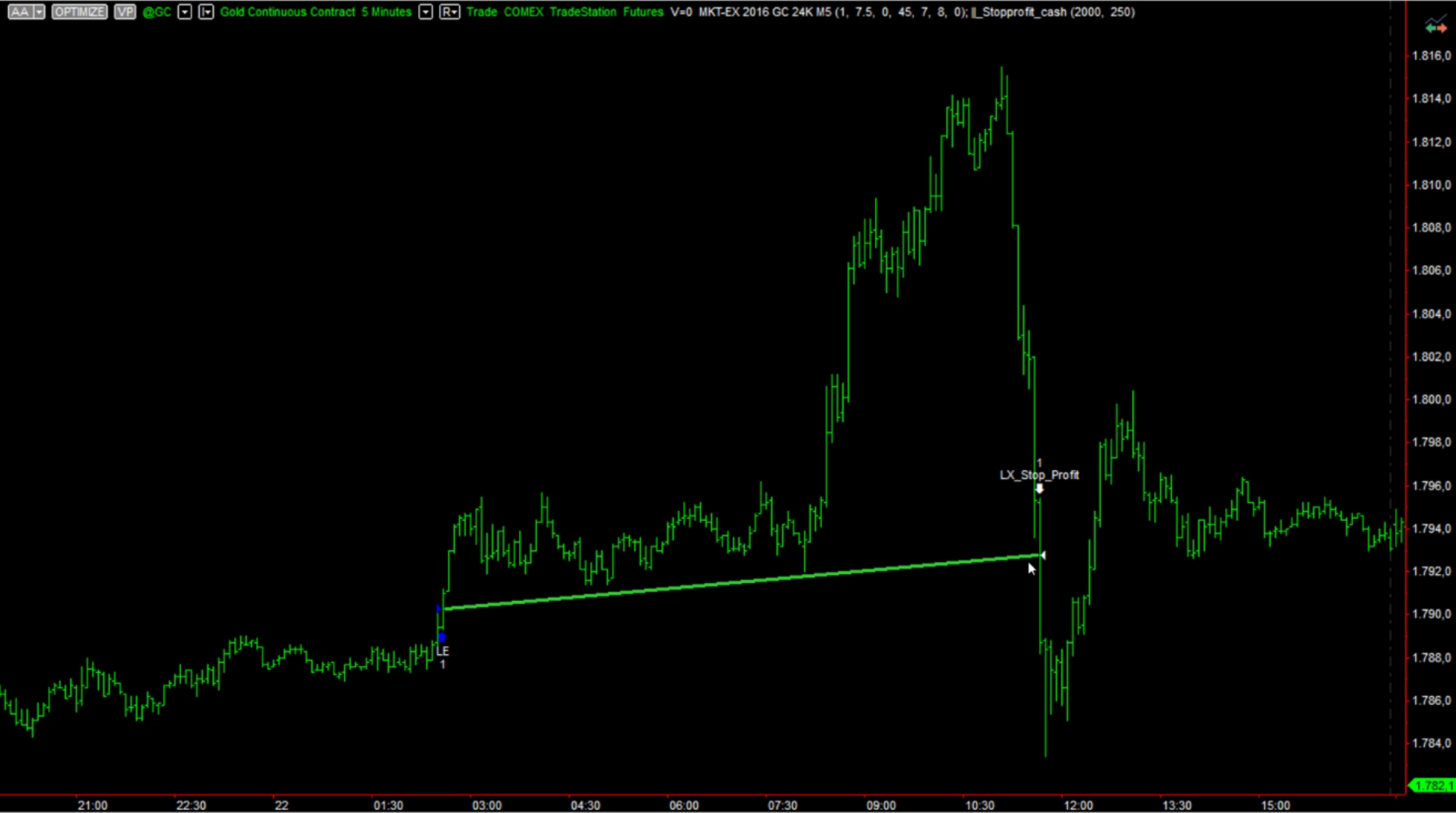

Below you will find an application example of this alternative Breakeven Stop, again on the Gold Future. You will notice that in this case, the Stop is set slightly above the break-even point.

How to Evaluate the Breakeven Stop Value

As already mentioned, it is very important to identify values that are sufficiently effective and robust within the Breakeven, as well as to identify them for the Take Profit and the Stop Loss.

In general, the Breakeven Stop should be neither too small nor too large.

Furthermore, it must be chosen by considering the time horizon of the system and the other exit orders of the strategy (stop loss and take profit). For example, a system that trades more frequently could probably have a slightly larger Stop than a system that operates in the short term.

Conclusion

With this article, we hope we gave you an overview of the Breakeven Stop. It is a very useful tool to effectively manage the risk that accompanies the activity of a trader, and for this reason, it is important to understand how to use it correctly.

As usual, if you want to learn more about the topic, you can consult the video above, or proceed with reading our article on the Stop Loss, which is one of the most important and fundamental of all the stop mechanisms.