In this article, we analyze the main features of the Trailing Stop. We will see how to set it and how it is different from the Breakeven Stop, with which it is sometimes confused. Finally, we will answer a hotly debated question: does the Trailing Stop really work?

What Is the Trailing Stop

The Trailing Stop is an order that allows you to protect a portion of the profits generated by a trade. It works by sending a stop order whose level is updated following the open profit of the position.

Unlike other orders such as the Breakeven Stop, the Trailing Stop does not have a fixed value at which the position is closed. We could compare “Trailing” to “staying in the wake”, and you can imagine this closing order as if it remained in the wake of a profitable position.

Imagine that you set a Trailing Stop of 10% of the purchase price, which we say is $100. In this case, if the price falls below $90, the Trailing Stop will be triggered and the position will be closed.

However, if the price goes up to $110, the Trailing Stop will be calculated as 10% of that amount, i.e. $11. So for the position to be closed, the price will no longer have to fall to $90, but to $99.

This “adjustment” of the stop order value is only valid if the trade continues to grow in profitability. So if the value were to drop from $100 to $96, for example, the closing threshold would remain at $90 and a new threshold would not be calculated based on 10% of 96.

As mentioned, the logic of this tool is to protect a portion of the earnings generated by following the trend of the trade.

This means that to use the Trailing Stop you need to set two values: the activation threshold and the reactivity (i.e. the distance) with which the position is followed. This distance is usually expressed in percentage terms, as in the example. However, it can also be expressed in monetary terms or points.

Differences with the Breakeven Stop

The Trailing Stop is sometimes confused with the Breakeven Stop. Although at first glance they may look very similar, they are actually very different orders.

The Trailing Stop follows the trade dynamically, updating itself as the market evolves. The Breakeven Stop simply moves the Stop Loss to the entry price as soon as the position reaches a certain level of profitability.

Although the Breakeven Stop is also used when a position turns out to be profitable, the big difference is that it is not updated as the trade evolves. In some cases, the Breakeven Stop can also be offset from the breakeven point, slightly higher or lower.

If you are interested in learning more about the Breakeven Stop and seeing how it can be used in a trading strategy, you can read this article.

The Unreliability of the Trailing Stop in Backtest

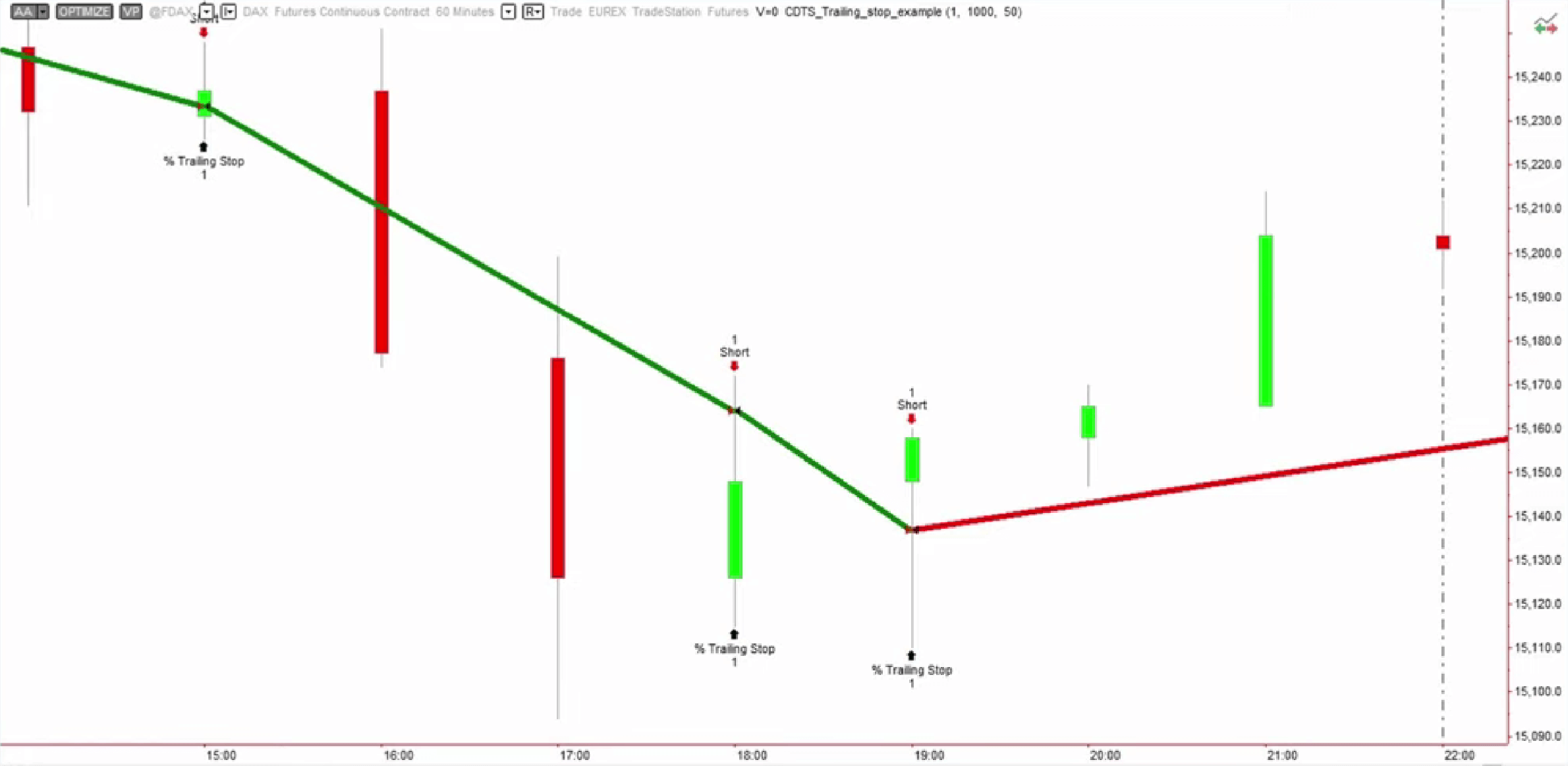

It is very important to keep in mind that on some platforms, using the Trailing Stop in backtest produces unreliable results.

In this video, one of our coaches explains the reasons behind this unreliability and provides a practical example. If you want to skip the introduction, watch the video starting from minute 3:45.

As demonstrated by the example presented in the video, during backtesting the platform performs the calculations relating to the Trailing Stop already knowing what the maximum and minimum values of the bars would have been, which obviously is not possible in real-time trading.

To overcome this problem, our advice for backtesting is to avoid keywords or functions that allow the platform to “peek” into the future and therefore falsify the validity of the backtest.

There is also another solution, perhaps even more valid, to independently code a Trailing Stop in such a way that it is completely impossible for the platform to refer to future bars. By doing so, in backtesting the platform will behave exactly as it would in live trading.

How Effective Is the Trailing Stop?

As always, our goal is to provide you with information that is as honest and transparent as possible. Based on our experience and multiple tests, we have concluded that the benefits of using the Trailing Stop are often minor.

Even adopting the measures suggested earlier, such as programming a Trailing Stop version yourself, the results do not show any significant improvement.

In general, we have noticed that the Trailing Stop tends to work best in large markets with lots of motion, where trend-following systems are usually used. In these cases, the benefits are mainly psychological, as the Trailing Stop can play a useful role when significant drawdown phases occur.

In this video, Andrea Unger says that he noticed that the Trailing Stop can produce a huge improvement in terms of drawdown and a slight improvement in the net profit in this type of system.

Conversely, the Trailing Stop tends to be rather useless in markets characterized by shorter, faster, and more chaotic movements.

Conclusion

In this article, we analyzed the Trailing Stop, how it differs from the Breakeven Stop, and mentioned the difficulties we have encountered in using it successfully.

As always, you can use these insights and tips in your trading. If you have not already done so, we recommend that you watch the video above to see for yourself a practical example of how NOT to use the Trailing Stop.