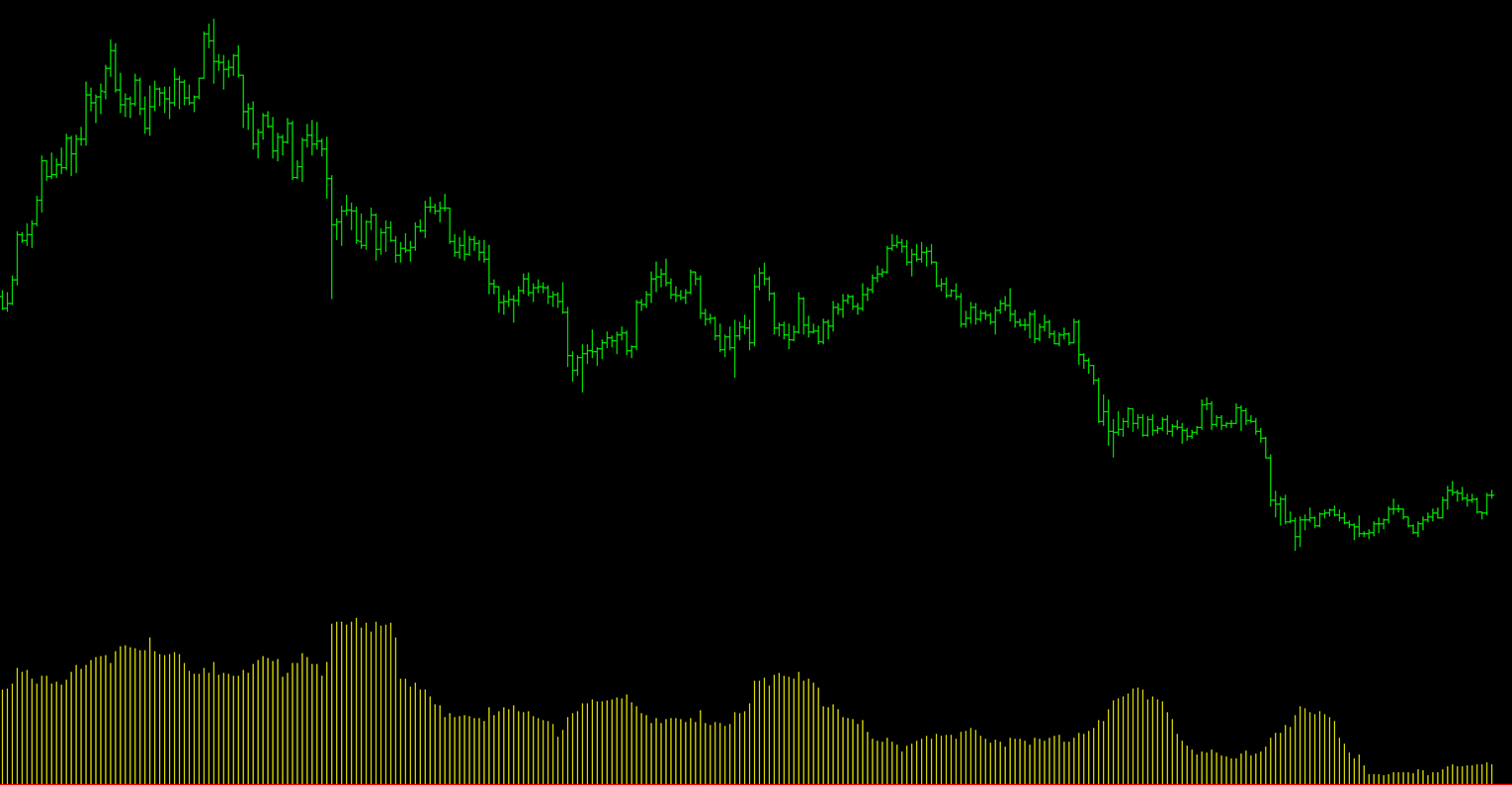

In this article, we will learn about ATR, how it is calculated, and how you can use it in your trading systems for investment and risk management.

Theory and History of ATR

The Average True Range (ATR) is a technical indicator used to measure the volatility of an underlying asset over a specific period of time. It was created in 1978 by Welles Wilder Jr, a famous analyst and commodity trader.

The main objective of the ATR is to quantify the volatility of a market.

The ATR value can help traders decide which markets to trade.

A high ATR indicates a market with high volatility (suitable for traders who are more willing to risk), while a low ATR expresses greater stability in the price of the asset and, therefore, a lower risk profile.

Generally, ATR in systematic trading is used in conjunction with patterns and price levels.

Other volatility-based indicators include the Bollinger Bands and the Keltner Channel.

How to Calculate the ATR

The ATR was designed to offer a mathematical measure of volatility.

It expresses the change in the price of a financial instrument in a specific period of time but does not reflect the market direction or its momentum.

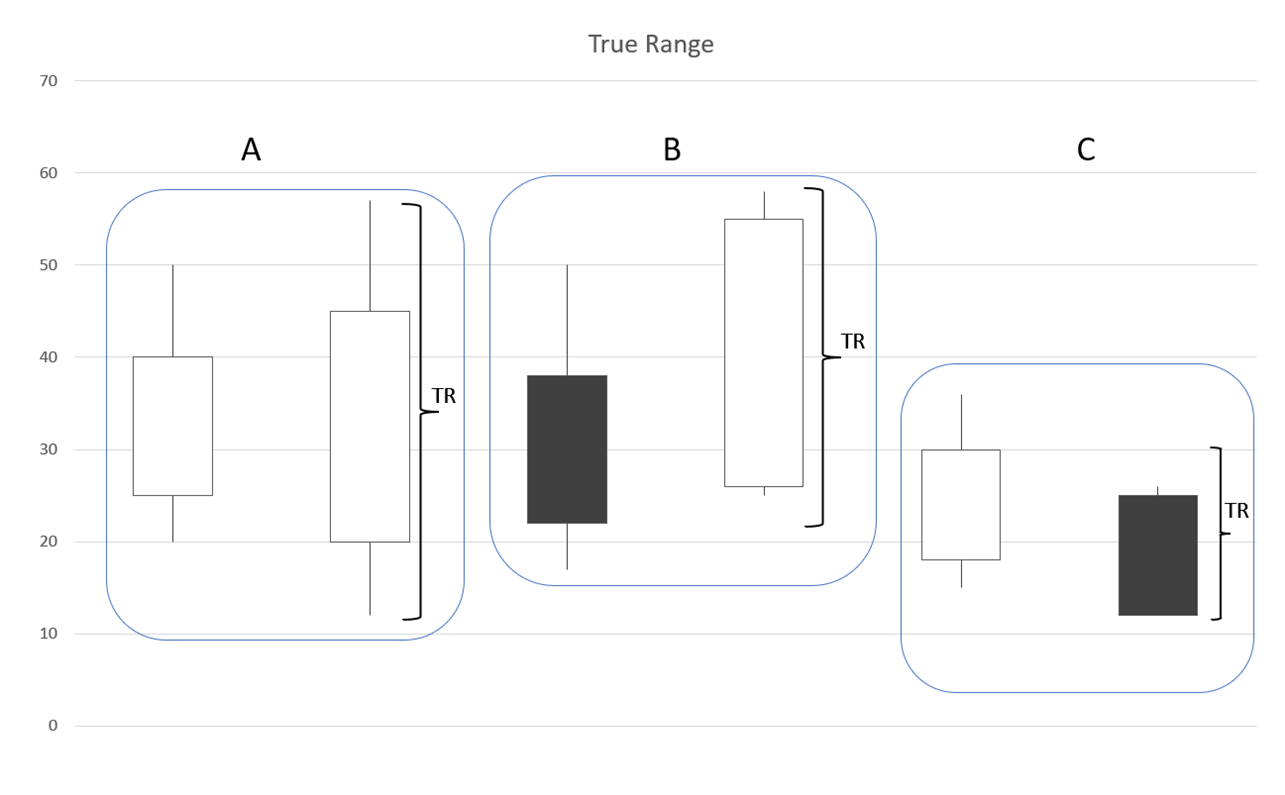

As the name suggests, the ATR measures the average “true range”, which is defined by three values:

-

The difference between the current high and the current low (case A in the image)

-

The difference between the current high and the most recent closing price (case B)

-

The difference between the current low and the most recent closing price (case C)

The calculation is made using the absolute values of each factor.

The ATR is generally calculated over 14 days but can also be calculated over longer (e.g., 20-50 days) or shorter intervals (2-10 days).

The ATR is, therefore, a moving average that allows traders to better analyze the volatility of an asset and get signals for their trading strategies.

ATR signals include:

-

High and rising ATR levels indicate increased volatility and a more volatile market situation.

-

Low and falling levels indicate a decrease in volatility and greater price stability which could be followed by a breakout.

Strategies for Systematic Trading Using the ATR

ATR values can be used by traders in investment strategies, hedging, and risk management.

In particular, the ATR helps a trader:

-

Identify possible breakouts to take advantage of a new trend

-

Knowing when to open or close a short/long position

-

Choose the right position sizing based on the volatility of the underlying

-

Determine where to place take profit and stop orders to control risk and protect your position.

Let’s see them in more detail.

1. ATR and Breakout

When the ATR settles at low values, it means that there is a situation of price stability and the market is probably sideways.

In these cases, it is good to carefully monitor the ATR because such phases of stabilization could be interrupted by sudden breakouts.

Identifying breaking points is essential for traders as it allows them to intercept and ride a trend from the very beginning. It is good to keep in mind that a surge in ATR only indicates that volatility is rising, and not the direction of the trend.

2. ATR and Opening/Closing Positions

The ATR can also be useful for determining when to open or close a position, be it short or long.

High or increasing ATR values suggest that the strength of the trend is increasing, so it is better to continue opening positions in the same direction. On the other hand, low or decreasing ATR values suggest that a breakout is likely to occur soon. From a practical point of view, when the current price diverges by more than 1 ATR from the closing price of the previous session, it means that the volatility has changed, and this information can help traders plan their strategies.

3. ATR and Position Sizing

Choosing the right position size is essential to avoid overexposure.

Thanks to the ATR, it is possible to size your investment by taking into account the volatility of the underlying asset. Generally, in very volatile and turbulent markets it is advisable to reduce the size of positions.

4. ATR, Take Profit and Stop Orders

The ATR is useful in deciding where to set take profit and stop orders. These orders allow you to protect your position and are essential from a risk-management perspective.

Among the orders that are most often used in synergy with ATR, we find the dynamic stop loss and the trailing stop.

The dynamic stop based on volatility uses the ATR or the standard deviation to set the maximum loss threshold that we are willing to bear.

In the following video, one of our coaches explains how to choose the most suitable stop loss values for the underlying assets you are trading on.

In addition, the video provides a practical example of how to set a dynamic stop loss based on the ATR.

Another way to protect your position when the ATR is high is with a trailing stop. As you can see here, placing this order allows you to protect yourself when the price of the asset undergoes unpredictable fluctuations.

On Which Markets to Use the ATR

Welles initially devised this indicator with the commodity market in mind. Today the ATR is used in many different markets, including Forex, stocks, and indexes.

Conclusions

The ATR is a technical indicator that measures the volatility of a market based on historical price data.

This indicator is used both for investment purposes and for hedging and risk management.

Using ATR can help traders establish when to open or close a long/short position and on which price levels to place orders such as the take profit, the dynamic stop loss, the fixed stop loss, or the trailing stop in order to protect their capital.

This way, one can have a more complete picture to better trade on a certain instrument.